Investment Focus

AQAL Capital invests in state-of-the-art exponential technology companies which have the potential for integral impact, including substantial growth, while implementing the UN SDGs within the Planetary Boundaries.

We focus on seed and early-stage companies. Their leadership team must be strong, their technology must be proven, and should have a short runway to cash flow break-even.

Our regional focus is the European Union with the main emphasis on DACH (Germany, Austria, Switzerland). A few selected investments are also made in the San Francisco Bay Area.

According to our Integral Investing philosophy, the business models of our investees must be transferable to other countries, be scalable to market leadership, and deliver sustainable and risk-adjusted returns on multiple bottom lines as defined by our 6Ps: Parity of People, Planet, and Profit — with Passion and Purpose.

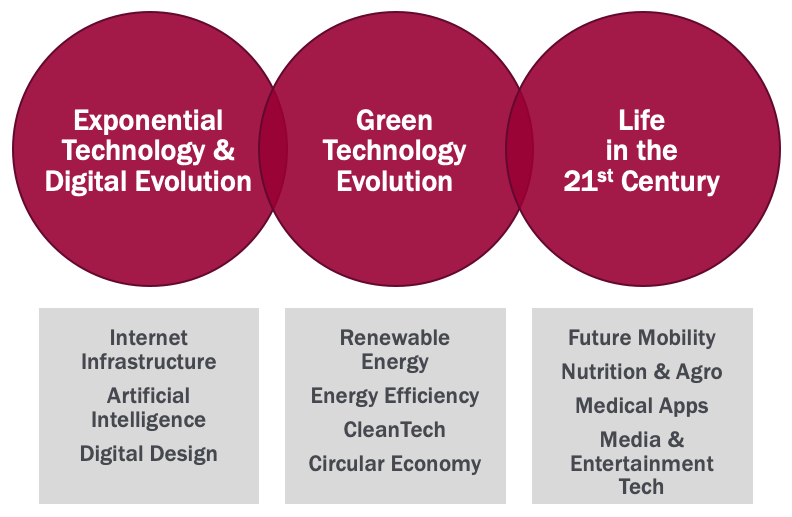

Given our investing expertise, background, and entrepreneurial experience, we are focusing on three main sectors of innovation for life in the 21st century:

- Exponential Technology & Digital Evolution: Internet Infrastructure, Artificial Intelligence, B2B IT Solutions, Digital Design

- Green Technology: Renewable Energy, Energy Efficiency, CleanTech, Circular Economy

- Life in the 21st century: Future Mobility, Nutrition & Agro, Med Tech, Media & Entertainment Tech

INVESTMENT FOCUS SHORT SUMMARY

Where: Mainly DACH region, EU; Silicon Valley

Phase: Seed, early Stage

Focus: Exponential Technology, AI, B2B IT Solutions, Energy / CleanTech, Digital Health / Med Tech, Media Tech, EdTech

Important: Integral impact, strong leadership team, proven technology, short runway to break-even

Investment type: Passive co-investments

Financial instruments: Equity and convertible instruments

Amounts: typically €25-100,000 for a 1st ticket in a seed stage start-up